Your ABC pension scheme

Your pension and climate change

YOUR ABC PENSION SCHEMEPension investments are affected by, and contribute to, climate change – we’ll explain how.

We’re making your investments better for the planet, which makes them better for your pension at the same time.

A sustainable pension is 21 times more effective at cutting carbon than stopping flying, going veggie, and switching energy supplier combined. That’s according to research by the campaign Make My Money Matter.

Better for your pension as well as the planet

We invest your pension to help it grow

We invest your pension money in companies, transport, buildings, and more, around the world.

Pension investments are affected by climate change

Take a shopping centre we invest in. Flooding, made more likely by climate change, could damage it. Droughts could destroy farmland that supplies food to supermarkets we invest in. These are risks that climate change poses.

As well as risks, there are potential benefits. To tackle climate change, we need clean energy, low-carbon tech companies, and more. Investing in companies that are well-positioned for the future helps your pension grow over the long term.

Pension investment emissions contribute to climate change

Most companies we invest your pension in create emissions. For example, a technology company that makes computers emits greenhouse gases as it makes each product. And it emits greenhouse gases as it lights and heats its factories and shops, and as its employees commute in and out of work.

So we’re working to reduce those investment emissions

Reducing emissions helps protect your investments from the risks of climate change, and benefit from the opportunities. It helps tackle climate change, while giving your money the best chance to grow for the future.

How we’re reducing our investments’ emissions:

Investing £500million in climate tech and clean energy

SunRiseAndShineCo builds some of the most efficient solar panels in the world.

OceanPlasticsCo sucks plastic from the sea and recycles it into benches, fences, furniture and decking.

These companies help tackle big challenges the world is facing – like the energy transition and protecting the oceans. So they’re well positioned to grow in the future, and give us a return on our investment.

Investing £400million in forestry and timberland

Our new investment in Scottish woodland helps restore and regenerate an area of the forest. Those trees capture carbon emissions from the air. And part of the forest is sustainably harvested for timber, to give us a return on our investment.

Using our investor influence to encourage the heavy polluters to change

We could just stop investing in companies that have high emissions. But this won’t solve the problem of climate change. It will just pass the problem on to the next person who invests in them.

Instead, we use our say. We vote at company meetings and work with their boards. We encourage them to reduce emissions, set climate targets, and improve how they treat the environment.

Our progress in numbers:

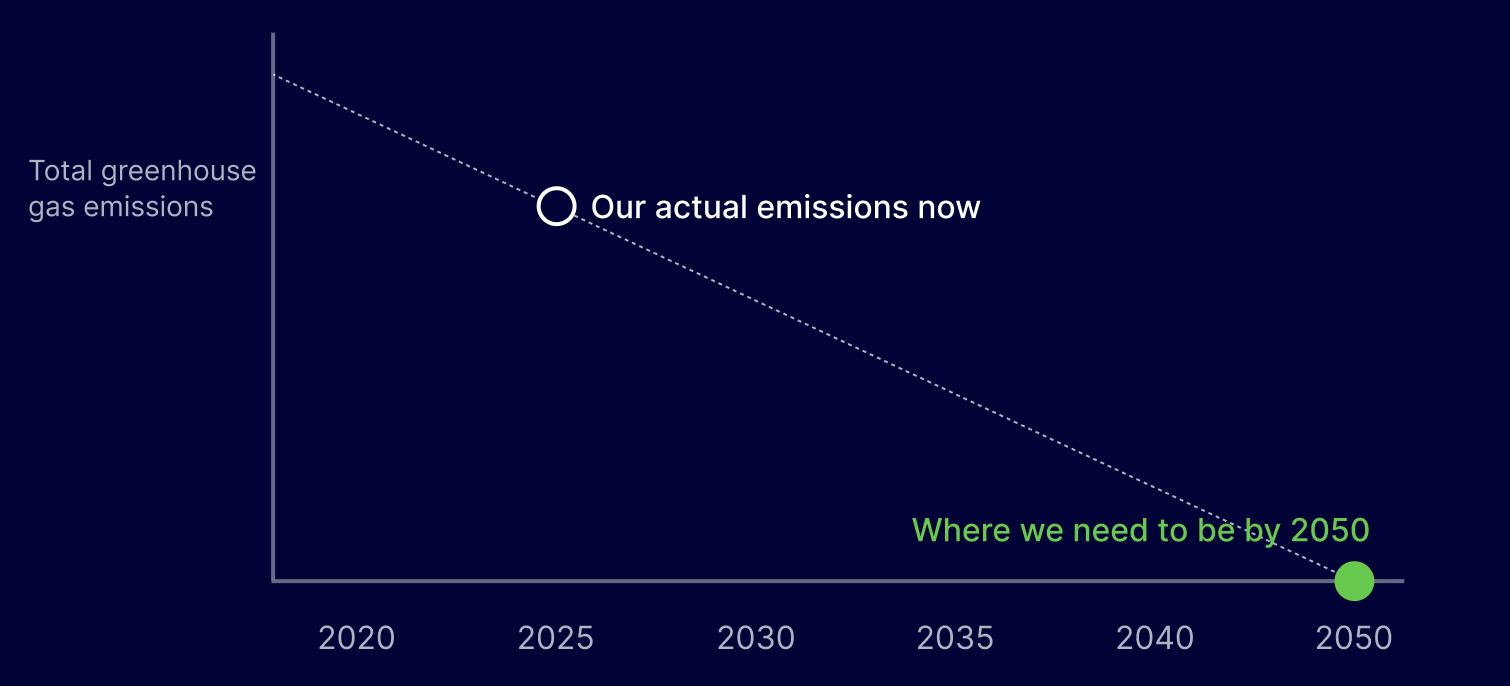

We’ve set a target to get to net zero emissions by 2050.

Reaching net zero means reducing emissions as much as possible. Any unavoidable emissions are cancelled out by removing greenhouse gases from the air, for example by planting trees. That way there’s zero emissions in total.

So far, we’re on track.

We measure our emissions every year

We report on them in our yearly climate change report, which we produce as part of the TCFD – the Taskforce for Climate-related Financial Disclosures. What you’re reading now is a snapshot of it. If you want to, you can read our full climate report.

Our carbon footprint

This measures our emissions intensity, which is the amount of greenhouse gas emissions per million pounds we invest. To reach net zero, our emissions intensity needs to reduce over time.

70 tonnes

of carbon dioxide equivalent per £million

68 tonnes

of carbon dioxide equivalent per £million

Our net zero alignment

This shows the percentage of companies we’re investing in that already have plans in place to be net zero by 2050. This figure should increase over time.

25%

125/500 companies we invest in

27%

135/500 companies we invest in

These numbers cover some but not all investment emissions.

They cover:

- emissions from a company’s day-to-day operations

- emissions from the energy a company pays for

But they do not cover:

- emissions from a company’s suppliers or supply chain

We are gathering supply chain emissions data, but it’s often unreliable. There’s more information about this, and how we continue to improve our emissions data, in our full TCFD report.